LECTURE NOTES FOR TODAY

The lecture notes for today can be downloaded from here.

The lecture notes work through a case study which is available here (Mobile Com plc).

There is an additional case study here (Haway Hate plc).

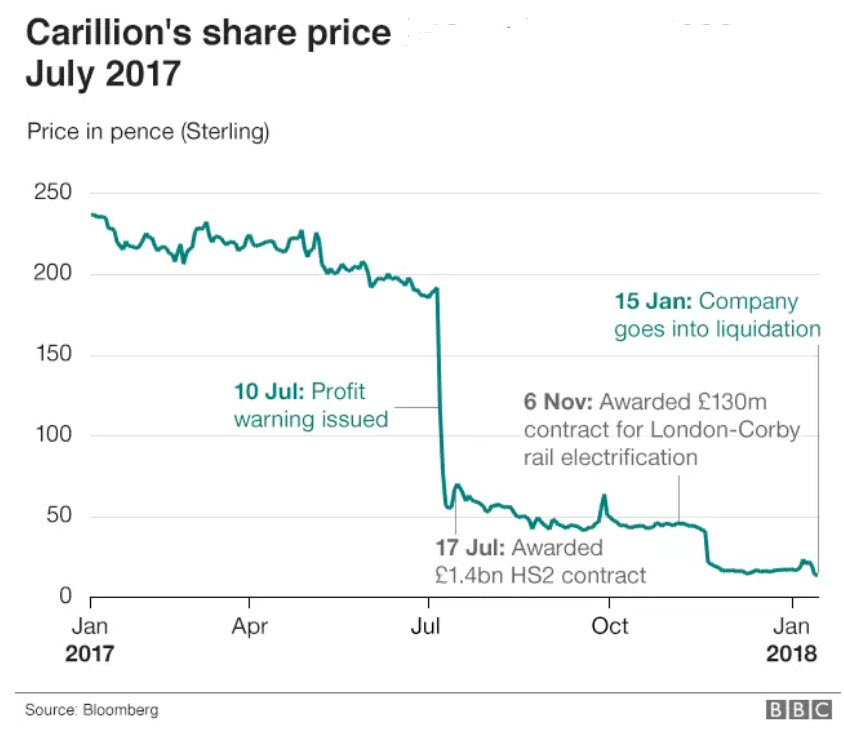

An International Accounting Standard regulates the measurement of revenue from construction contracts. Typically construction contracts involve lots of resources and large sums of money. They also tend to span more than one accounting year, and can be subject to varying degrees of uncertainty as the contract progresses. Things can go wrong perhaps unexpectedly – see Carillion shares slump

Source: BBC

There will be few problems if a contract is started and finished in the same financial year. The revenue earned and costs incurred on the completed contract will be measurable – and hence the profit or loss. However, if a contract spans two financial years (even if the contract lasts less than 12 months) there will be measurement issues at the end of the first financial year.

Let’s imagine a company engages in a three year construction contract which is expected to be profitable. How should the expected profit on the contract be taken.

Should it all be taken in the first year? Foolhardy, or not?

Or would it be prudent to wait and report no profit on the contract until the final year? Too conservative? If the contractor wants to take some profit each year, is that allowed? and how can be taken each year? Also, how should the contract be reported in the financial statements? A lot of questions there. So do the accounting standard setters have anything to say on this? Well, yes they do. And it’s all to do with reporting the profitability of the contract reliably [and prudently] over the life of the contract.

… but things have changed

However, things changed from 1 January 2018* when standard IFRS 15 Revenue from Contracts with Customers came into operation. The standard replaced a number of previous standards with a principles based five-step model to be applied to all contracts with customers. Those five steps are:

- Identify the contract(s) with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations in the contract

- Recognise revenue when (or as) the entity satisfies a performance obligation.

* deferred from 1 January 2017 [IASB, 11 September 2015]

Reading on the new standard (IFRS 15)

Impacts on the construction industry of the new revenue standard. A downloadable 18 page pdf document discussing the impact of IFRS 15 on the Construction Industry.

Impact on the aerospace industry

EY Applying IFRS in Engineering and Construction

Optional additional reading and viewing on the impact of the new standard

- Video with worked example

- Another video with worked example

- A final video which sums up what’s required in just a little bit more than you need

- Video discussion produced by Deloitte on the impact of IFRS on different sectors. Really good stuff!

NB

KPI = Key performance indicator

IFRS = International Financial Reporting Standards

USGAAP = United States Generally Accepted Accounting Principles, a separate set of Accounting Standards produced by the FASB (fasbee), the Financial Accounting Standards Board, the US body similar to the IASB (International Accounting Standards Board). The IASB and the FASB work closely together with a view to harmonising accounting standards. - IasPlus for general discussion of IFRS 15

- IFRS 15 Revenue from Contracts with Customers for more detailed discussion of the application of the standard to construction contracts.

- IFRS 15 Examples: How IFRS 15 Affects Your Company a well illustrated article showing comparisons between IAS 11 and IFRS 15 with numerical examples.