Lecture material

The lecture notes for this session are here.

There is an online presentation on investor ratios available at ecourse.co.uk/eps. This will run on your computer or ipad. You may need to download a free player app to use on the Apple ipad.

There is also a worksheet showing worked examples for calculating earnings per share figures in a number of situations.

Investor ratios

This week we’ll start looking at company financial statements from the perspective of an investor, concentrating on some of the financial indicators (often ratios) which are used in the financial press and which are useful to investors and potential investors in a company.

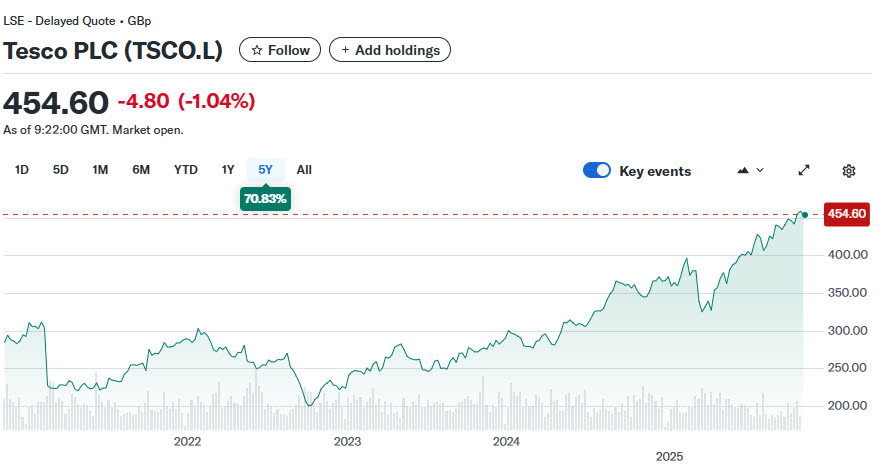

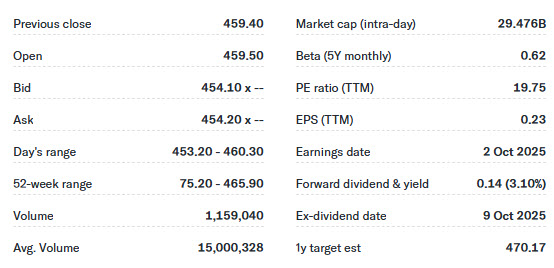

Last week we looked at the Hunting plc (The Stobart Group was 100% taken over by Muller Group, renamed Esken Ltd, and delisted). This week we will revert to Tesco. There are lots of sources of investment information on the web. Some cost a lot of money (that’s because they are useful – and contain real time information, comment and analysis). Others are free and will be good enough for our purposes. One such is Google Finance and you can find stock market information on Tesco at Google Finance. A good alternative is Yahoo Finance (see below). Spend some time exploring these pages and following some of the links to get a feel for the information. Also practice looking up the information for other companies.

The section on stocks at about.com may be quite useful in supporting your studies – particularly the section on Fundamental Analysis.

Case studies

Once you’ve worked your way through the worksheet have a go at these case studies:

Brora plc – bonus issue and new issue of shares at full value.

Champlon plc – rights issue and new issue of shares at full value.

Relating to Champlon Plc

How was the rights issue calculated? I feel like some of the figures calculated in the solution are wrong

Could you please explain the entire solution Donald?

Which figure(s) do you think is/are wrong? The solution includes full calculations.

DH

Hello Donald, under brora plc the bonus issue of 20m shares are treated retroactively as if they have been outstanding for the entire year and under champlon plc the rights issue are adjusted for the period in which they were outstanding (8 months). What is the main difference between bonus shares and rights issue and why are they treated differently? Is it because rights issue raises additional capital?

Hi Ravi

That is the correct treatment where there has been a bonus issue. See the course notes for more details.

Best wishes

Donald

Hi, Donald,

may I ask you one issue about BRORA PLC Case study calculation?

I use another method to calculate EPS for 2016.

EPS for 2016=(profit after tax )/(After bonus issue+New issue)

=£9710000/(220000000×(10/12)+228500000×(2/12))

=£9710000/221416666.7

=4.4 pence

And the result is very similar to the suggested solution.

Can I use this method to calculate EPS?

Thanks!

Hi Lan

Yes that’s fine.

There are 200,000,000 shares in issue at the beginning of the year.

The bonus issue is 1 for 10 = 20,000,000

So the total after the bonus issue is 220,000,000

The new issue is 8,500,000 shares but for 2 months only.

The two ways to calculate the denominator are:

METHOD ONE

220,000,000 for full year = 220,000,000 x12/12 = 220,000,000

8,500,000 new shares for 2 months = 8,500,000 x 2/12 = 1,416,667

Total = 220,000,000 + 1,416,667 = 221,416,667

or

METHOD TWO

220,000,000 for 10 months = 220,000,000 x 10/12 = 183,333,333

228,500,000 for 2 months = 38,083,333

Total = 183,333,333.33 + 38.083.333 = 221,416,667

They really are the same thing.

Best wishes

Donald

Donald, when we calculate “Weighted average number of shares issued” in a case that a company issued ex-rights, why do we need to calculate the adjustment factor and use it to time outstanding shares? i.e.

Computation of adjustment factor

Fair value per share before exercise of rights £ 2.10

Theoretical ex-rights value per share £ 2.04

Adjustment factor 1.029411765

Weighted average number of shares issued

First two months

80,000,000 times 1.02941 times 2/12 13,725,490

Hi Jie

Firstly, you should review how a bonus issue of shares affects the calculation of eps.

Secondly, you should review how an issue of shares at full market price affects the calculation of eps.

Then when you come to the calculation of eps where there is a rights issue the calculation needs to recognise that a rights issue is partly a bonus issue (because the shares are issued at a discount) and partly an issue at full market price.

That will help you with the calculation of the eps where there is a rights issue.

Please also read the relevant lecture material for eps.

Hope this helps a bit. It’s not easy or intuitive though.

Best wishes

Donald

Relating to: BRORA PLC question

Why is the number of shares for both 2016 and 2015 after bonus issue is 220,000? Why didn’t we use the figure 228,500,000 when calculating it for 2016?

Hi ABC

It’s tricky, and the suggested solution is perhaps not as clear as it could be.

According to the question data the number of shares issued was:

as at end of June 2015 200,000,000

as at end of June 2016 228,500,000

This can be explained as follows:

Number of shares issued at start of current year =200,000,000

Bonus issue of shares (1 for 10) adds 20,000,000

Bring the total to 220,000,000

Then there’s the issue of new shares 8,500,000

Bringing the total at the end of the current year to 228,500,000.

So the bonus issue of shares is already included.

That’s the number of shares issued at the end of the year. However, the earnings figure covers the whole of the year. So we have to work out the weighted average number of shares for the year to calculate the EPS figure.

Hope this helps.

Best wishes

Donald

Relating to: BRORA PLC Case study calculation

1) Why has the bonus issue of 1 for 10 from 1 Nov 2015 an full effect of 20,000 increase in no. of shares pf 2015 and not just 20,000/12*2 =3333.33 ?

2) the new issue of 8,500 shares is published on 1 May 2016. So should it be 8,500/12*8 instead of 8,500/12*2 ?

I think the solution is correct.

The bonus issue does not raise any additional finance. It is merely a reclassification of existing capital. So for consistency and comparability the increased number of shares is backdated to the start of the current year and the whole of the previous year.

The new issue of shares raises additional finance but only for two months. Remember the end of the financial year is 30 June (not 31 December) so the extra finance has only been available for two months.

These treatments are consistent with the worksheet provided as part of the lecture notes.

Best wishes

Donald