[CORE] Group structures, parent companies and subsidiaries, joint ventures and associated companies

Resource Checklists

Essential core learning and study resources referred to in this post:

- An introduction to group financial statemenets – elearning resource [A]

- A self study workbook on the preparation of group income statements [B]

- A worksheet on the adjustments in group financial statements for intercompany trading [C]

Additional resources:

- Why have subsidiaries [D]

- Legal definitions [E]

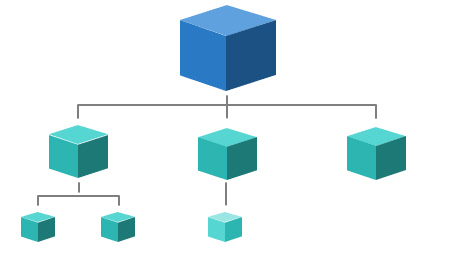

Almost all economically significant companies conduct their business through group structures i.e. through subsidiaries, associated companies and joint ventures. This is because there are significant operating, managerial, financial and strategic advantages by organising the enterprise in this way. The companies you will be looking at as part of your other studies and research activities will all be groups of companies. So, you really do need to understand the financial statements for these groups.

In this session we will start looking at the features of consolidated financial statements [group accounts]. We’ll look at the nature of a group, and the holding company/subsidiary relationship. We’ll see how this is based on control rather than ownership, and the consolidated financial statements that holding companies are required to prepare and publish are based on this concept of control.

You can see the online notes as an elearning resource here – essential [A]

[CORE] Directed Private Study – numerical work – group income statements

There is a printed online guide (essential [B] to the preparation of consolidated income statements. Guidance will be given in the lecture sessions as to which parts of this material you need to cover.

[CORE] Intercompany trading

There’s also a worksheet on intercompany trading – essential [C] and consolidated income statements as this can be a tricky issue for accounting students.

[CORE] There are also two additional pieces of elearning which will help you understand more fully the strategic and legal issues surrounding subsidiaries

Corporate strategy – Why have subsidiaries?

There is an online presentation [D] on why companies have subsidiaries. It lasts about 10 minutes but covers a lot in that time. You can, of course, take it at your own pace. It may appear a bit dated now, and some of the links in the resources box no longer all work, but it’s still good stuff. This material is self explanatory, so please include it in your own private study.

Legal issues – What is a subsidiary?

There is also an online presentation on what is a subsidiary [E] – again fairly good stuff, if a bit legalistic. It contains some good quizzes that will really test your understanding! The references are to the Companies Act 2006 (downloadable pdf) or here (online version).

[CORE] Two Worked Case Studies

These help you check your understanding

Have a go at Danser and Empart.

and – Brojum and Drorral.

[ADD] Video overview

Here’s a video of an online session recorded last year. You’ll need a password – it’s 83408.

Hi Donald,

With regards to case 6 and case 7 in the online guide for the preparation of consolidated income statements, I would like to ask about why the calculation of costs are different.

Thank you so much

Hi

Your question is not very clear – but I think the answer is that in Case 6 the holding company (H) sells to the subsidiary company (S). However, in Case 7 the subsidiary company (S) sells to the holding company (H). It makes a difference! It is explained in the commentary to each case – have another read and see if this helps you. The most usual situation you will come across is the Case 6 situation, where the holding company sells to the subsidiary.

Best wishes

Donald

Hello Donald,

Can I ask you a question about how to calculate dividend from Empart plc to Danser plc? The solution shows that it is ‘70%of 1000’. I understand the meaning of ‘70%’ while how can I find ‘1000’? Thank you very much.

Regards

Hi Yiling

Empart’s share capital is £20,000K in £1 shares (see its Statement of Financial Position). It paid a dividend of 5 pence per share. So the total dividend paid by Empart to its shareholders was:

20,000K x .05 = 1,000K

Danser owns 70% of the shares in Empart so it will receive 70% of the dividend i.e. 70% of 1,000K = 700.

Hope this helps.

Hi Donald,

I have one question about the case study of Danser and Empart. when consolidate the operating expense, there is a amortisation of know-how which is 100. however, according to the information, I don’t know where it from

thanks,

Hi

If you read through the question you’ll see that knowhow in the subsidiary is recognised on the acquisition of the subsidiary. You’ll also be given a value of the knowhow as at the date of consolidation. This is 100 lower, and is the decrease in value of the knowhow. This is reported as an expense for the year. I don’t have the original figure to hand as I am on the train at the moment.

Hope this helps.

Best wishes

Donald

Hi Donald,

According to online material, do you have a solution for case 6?

After I looked through the solution in page 30, it seems not relevant to the case6 exercise.

Thank you so much

Hi Jan

Apologies for the problem you’ve identified. It was caused by a bug in the linking of the text directly to the spreadsheet model – too complex to go into here. Anyway. It should be sorted now. So please clear your browser’s cache and download the file again.

Best wishes

Donald

It didn’t work,I still can’t find the solution of case6

Hi Quincy

It’s on pages 30 and 31, immediately after Case 6.

Best wishes

Donald

Hi Donald,

In the online material from http://www.ecourse.co.uk/materials/consolidations/consolpl_17.pdf, there are some cases where after all calculations, there is a part for ‘checking the figure for group profit’ e.g. in the solution for Progress Question 3. Do we have to present this in the exam?

Thank you.

Hi there

No, you don’t – unless, of course, you are specifically asked for it (which you won’t!).

Best wishes

Donald

Hi Donald,

With regards to case 6 and case 7 in the online guide for the preparation of consolidated income statements, I would like to ask about the different calculation of non-controlling interest. Both cases have unrealised profits in it, however, only unrealised profit in case 7 that is deducted to calculate the non-controlling interest. Is there any specific explanation for this? Thanks.

Hi Yessika

I think the difference is that in Case 7 the intercompany sales have been made from the subsidiary to the holding company, whereas in Case 6 the intercompany sales were made from the holding company to the subsidiary.

The deduction for unrealised profit should be in the financial statements of the company initiating the trading. If that company is the subsidiary then the figures used to calculate the non-controlling interest will be affected.

Hope this helps.

Best wishes

Donald