This week we will look at the financial structure of a company. We’ll look at how companies are financed, and the relationship between debt and equity, as well as the nature of long and short term finance. We’ll use the financial statements of the Hunting plc to support the session. You can download the group’s financial statements (for 2024) from here or from Companies House.

Lecture material

The lecture material for today’s session is available here.

Here is the graph of Hunting plc’s share price over the past five years.

Source: Google Finance, 23 October 2025

Source: Google Finance, 23 October 2025

What does this tell you about the performance and/or prospects of Hunting plc?

Gearing

The relationship between debt and equity is called gearing (leverage in the US). The higher the proportion of borrowing to shareholders capital the higher the financial risk of both equity shareholders and lenders. Risk here means the variability of the returns to shareholders and lenders.

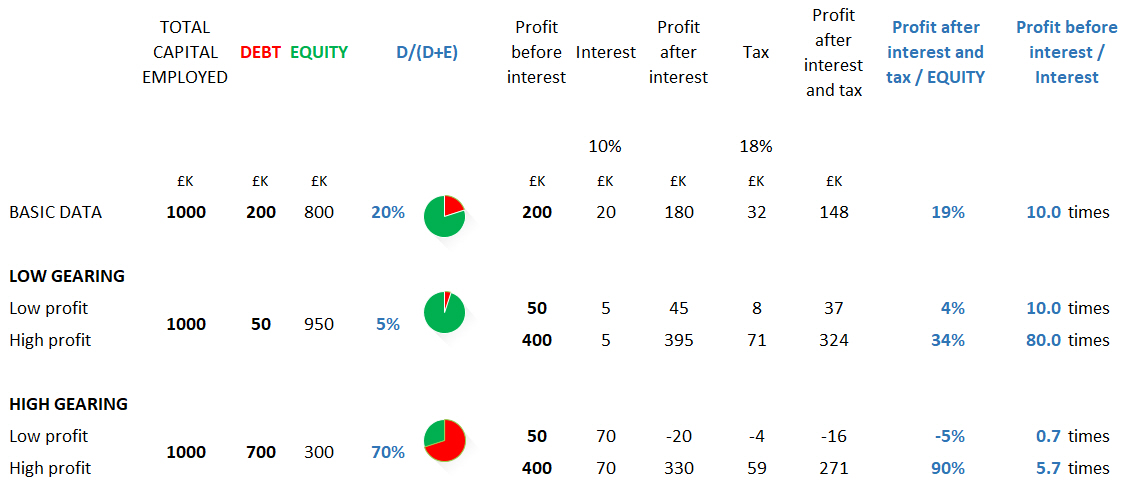

This is demonstrated in the following spreadsheet.

The first line shows example figures from the financial statements. Capital employed is analysed into debt and equity. The relationship between equity and debt is gearing – here 20%.

Continuing along the first line, there are example figures from the Income Statement. Interest is 10% of debt (10% 0f 200). Tax is calculated at an effective rate of 18% of profit after interest. Profit after interest and tax as a percentage of equity (148/800) (19%) is calculated – this is return equity.

The ‘LOW GEARING’ section deals with a company which has the same capital employed as the ‘basic data’ company i.e. 1000. However, its gearing is low – 5%. The table shows that a profit of 400 will give equity shareholders a return of 34%. If profit fell to 50 the return on equity would fall to 4% – a drop of 30 percentage points.

The ‘HIGH GEARING’ section shows a company with high gearing (70%). When gearing is high a profit of 400 will give equity shareholders a return of 90%. If profit fell to 50 return on equity would fall to -5% – a drop of 85 percentage points.

So the variability of returns (and hence financial risk) to the shareholders is higher when gearing is high. So high gearing increases the financial risk of both lenders and shareholders.

However, in the right circumstances gearing can be used creatively to increase the returns to equity shareholders (here, 34% to 90%).

Exam type questions

Your exam will contain TWO short essay questions. Here are typical examples:

Question 1

‘It is evident, however, that operational and financial gearing have the common feature that an increase in either … reduces the earnings available to shareholders and thereby increases their risk.’

John Ogilvie, Financial Strategy

CIMA, 2009, p160

Required

Demonstrate how increasing financial gearing increases the risk of both lenders and shareholders.

Discuss whether or not more efficient working capital management can reduce financial gearing.

Question 2

a) Using the financial statements of Flybe Group plc for 2016 (you can download from here) calculate capital and operating gearing ratios for 2016 and 2015 and assess the level of gearing of the group over the two years.

b) Compare your calculations with Flybe’s own calculation of gearing (page 109) exploring the reasons for any differences. Which measurement basis do you think is the best?

c) An investment section in a newspaper gives the following gearing information for Flybe:

Net Gearing (%) 44.12

Gross Gearing (%) 72.89

Debt Ratio (to 1) 49.26

Debt-to-Equity Ratio 0.36

Research how these ratios have been defined. How to these values compare with your own calculations and the company’s calculation?

Additional resources on liquidity and cash flow management

We’ll also try and find the time to look at a short case study – Lemonstane plc – on the use of the statement of cash flows to evaluate liquidity. There is suggested solution here.

Additional Supportive Reading

Optimum capital structure ACCA F9 Revision Material

Capital Structure Decisions of a Public Company Oxford Academic (you may be able to get free access)