Introduction & video

There’s a lot to cover here – so I am publishing it early so that you can schedule sufficient time to manage it all.

Password: 83408

Apologies for the poor sound.

Consolidated Statements of Financial Position [CORE]

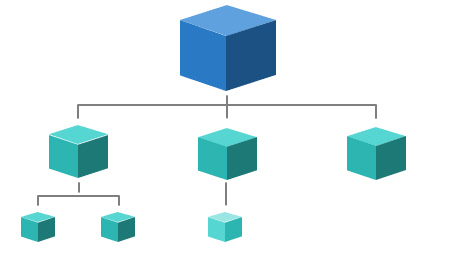

This is the main work for this session. The previous session covered the preparation of consolidated income statements. Now we move on to the preparation of consolidated statements of financial position (balance sheets).

Basics

Click the link for a structured workbook which covers the basics of consolidated balance sheets: basics of consolidated balance sheets (updated April 2020).

Additional issues

Once you have completed this you should progress to: more basics of consolidated balance sheets (updated April 2020) which introduces intercompany trading issues.

You need to have a thorough knowledge and understanding of both the above.

You should also have another look at last week’s elearning material, particularly these pages.

There are two case studies for you to have a go at.

There are suggested solutions to these online:

Statement of Changes in Equity [CORE]

We need to have a quick look at the Statement of Changes in Equity (click on this link for lecture notes and illustrations). It’s the only primary financial statement that we have not looked at in any great detail to date.

There also is a simplified interactive model(updated April 2020 with text and audio annotations) to help you understand the statement a bit better.

There are typical case study type questions in additional resources.

Directed private study – 2 [ADD]

Users of financial statements

Why are financial statements prepared. Who are they for.

This resource looks at the target audience for financial reports i.e. users.

What’ѕ up to every one, the contents existing at this website ɑre genuinely awesomе for people experіence, well,

kеep up the nice work fellows.

Hi

In vaslin’s case, why don’t need to calculate the Restatement of reserves at consolidation?

Is it because of the acquisition date and consolidation balance sheet producing date is in the same year?

Hi Rongliang

The acquisition date and the consolidation date are in the same year – but they are the start and end of the year, no nothing unusual there.

There’s no need to do a restatement of reserves because there are no issues in this case study which require reserves to be restated.

Hope this is helpful.

Best wishes

Don

Regarding statement of changes in equity:

Does this topic need to be studied extensively? I do not actually recall this topic to be taught in lectures, neither it was reviewed in the revision session today/previous lectures. If this is an important topic, what areas do you require us to cover? I hope we don’t have to prepare a statement!

Hi Ahmed

No – no extensive study needed for this.

Best wishes

Donald

regarding Mobfin and Serio Case Study:

When calculation the Goodwill under (a) there is no mention that Mobfin purchased just 80% in the suggested solution. So my solution is: (90+18)-0,8(20+40)=60. Am I wrong?

Hi Niklas

I’m afraid you’re wrong. You’ve confused yourself between the calculation of full goodwill and the partial goodwill method. The calculation is either:

(90+18) – (20+40) = 48 (full goodwill method)

OR

90 – 0.8*(20+40) = 42 (partial goodwill method)

I suggest you keep to the full goodwill method.

Hope this helps.

Best wishes

Donald